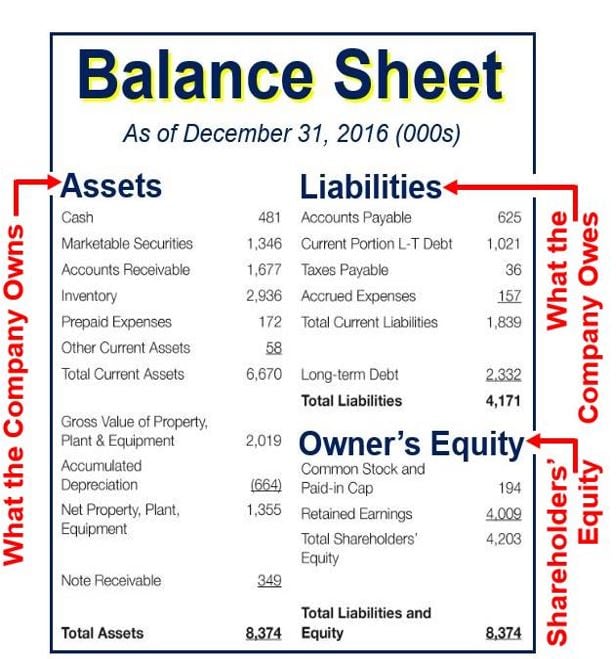

Is Office Supplies An Asset Liability Or Owner's Equity . office supplies are usually considered an expense. examples of expenses are office supplies, utilities, and advertising costs. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. Now let's look a closer look at each. items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. Liabilities, on the other hand, are. For a sole proprietorship or partnership, equity is. As the supplies on hand are normally. When you take all of your assets and subtract all of your liabilities, you get equity. But things can get tricky when dealing with office supplies, office expenses, and. although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. when a business purchases office supplies on account it needs to record these as supplies on hand.

from dxopgwzwh.blob.core.windows.net

items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. examples of expenses are office supplies, utilities, and advertising costs. office supplies are usually considered an expense. As the supplies on hand are normally. although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. Liabilities, on the other hand, are. Now let's look a closer look at each. For a sole proprietorship or partnership, equity is. when a business purchases office supplies on account it needs to record these as supplies on hand. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the.

Types Of Owner's Equity Accounts at Zane Manson blog

Is Office Supplies An Asset Liability Or Owner's Equity Now let's look a closer look at each. although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. when a business purchases office supplies on account it needs to record these as supplies on hand. When you take all of your assets and subtract all of your liabilities, you get equity. examples of expenses are office supplies, utilities, and advertising costs. items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. Liabilities, on the other hand, are. For a sole proprietorship or partnership, equity is. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. As the supplies on hand are normally. Now let's look a closer look at each. office supplies are usually considered an expense. But things can get tricky when dealing with office supplies, office expenses, and.

From www.wikihow.com

How to Calculate Owner’s Equity 6 Steps (with Pictures) wikiHow Is Office Supplies An Asset Liability Or Owner's Equity As the supplies on hand are normally. But things can get tricky when dealing with office supplies, office expenses, and. office supplies are usually considered an expense. When you take all of your assets and subtract all of your liabilities, you get equity. Liabilities, on the other hand, are. For a sole proprietorship or partnership, equity is. when. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.invoiceberry.com

The balance sheet contains three sections assets, liabilities, and Is Office Supplies An Asset Liability Or Owner's Equity Now let's look a closer look at each. For a sole proprietorship or partnership, equity is. although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. As the supplies on hand are normally. once the liabilities have been paid from the assets, whatever is left represents. Is Office Supplies An Asset Liability Or Owner's Equity.

From financialfalconet.com

List of Assets, Liabilities, and Equity with Examples Financial Is Office Supplies An Asset Liability Or Owner's Equity once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. But things can get tricky when dealing with office supplies, office expenses, and. Liabilities, on the other hand, are. As the supplies on hand are normally. When you take all of your assets and subtract all of your liabilities,. Is Office Supplies An Asset Liability Or Owner's Equity.

From in.pinterest.com

Accounting equation with assets, liabilities and owner equity outline Is Office Supplies An Asset Liability Or Owner's Equity although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. For a sole proprietorship or partnership, equity is. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. items are purchased or sold, credit is. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.slideshare.net

4.3 The Rules for Assets, Liabilities and Owner's Equity Is Office Supplies An Asset Liability Or Owner's Equity When you take all of your assets and subtract all of your liabilities, you get equity. office supplies are usually considered an expense. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. although it is infrequent, in some cases, office supplies are treated as a current. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.freshbooks.com

What Are Assets and Liabilities A Primer for Small Businesses Is Office Supplies An Asset Liability Or Owner's Equity office supplies are usually considered an expense. As the supplies on hand are normally. For a sole proprietorship or partnership, equity is. Liabilities, on the other hand, are. examples of expenses are office supplies, utilities, and advertising costs. But things can get tricky when dealing with office supplies, office expenses, and. Now let's look a closer look at. Is Office Supplies An Asset Liability Or Owner's Equity.

From learninglibrarysisk.z4.web.core.windows.net

Assets Liabilities Owner's Equity Worksheet Is Office Supplies An Asset Liability Or Owner's Equity examples of expenses are office supplies, utilities, and advertising costs. For a sole proprietorship or partnership, equity is. office supplies are usually considered an expense. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. When you take all of your assets and subtract all of your. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.chegg.com

Solved Identify each of the following accounts as Asset, Is Office Supplies An Asset Liability Or Owner's Equity office supplies are usually considered an expense. examples of expenses are office supplies, utilities, and advertising costs. although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. Liabilities, on the other hand, are. For a sole proprietorship or partnership, equity is. once the liabilities. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.patriotsoftware.com

What Is the Accounting Equation? Examples & Balance Sheet Is Office Supplies An Asset Liability Or Owner's Equity items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. As the supplies on hand are normally. although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. once the liabilities have been paid from the assets, whatever is. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.chegg.com

Solved Assets Cash Office Supplies And Salaries Expense O... Is Office Supplies An Asset Liability Or Owner's Equity items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. When you take all of your assets and subtract all of your liabilities, you get equity. Now let's look a closer look at each. But things can get tricky when dealing with office supplies, office expenses, and. For a sole proprietorship or. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.studypool.com

SOLUTION What is assets , liability, owner's equity and balance sheet Is Office Supplies An Asset Liability Or Owner's Equity examples of expenses are office supplies, utilities, and advertising costs. But things can get tricky when dealing with office supplies, office expenses, and. when a business purchases office supplies on account it needs to record these as supplies on hand. although it is infrequent, in some cases, office supplies are treated as a current liability when the. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.bartleby.com

List the classification of each of the following accounts as A (asset Is Office Supplies An Asset Liability Or Owner's Equity Liabilities, on the other hand, are. As the supplies on hand are normally. examples of expenses are office supplies, utilities, and advertising costs. Now let's look a closer look at each. items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. But things can get tricky when dealing with office supplies,. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.slideserve.com

PPT Accounting Equation PowerPoint Presentation, free download ID Is Office Supplies An Asset Liability Or Owner's Equity although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay. As the supplies on hand are normally. examples of expenses are office supplies, utilities, and advertising costs. For a sole proprietorship or partnership, equity is. once the liabilities have been paid from the assets, whatever. Is Office Supplies An Asset Liability Or Owner's Equity.

From exovnqpla.blob.core.windows.net

What Are Assets Liabilities And Owner's Equity at Kevin Jarrett blog Is Office Supplies An Asset Liability Or Owner's Equity Now let's look a closer look at each. For a sole proprietorship or partnership, equity is. When you take all of your assets and subtract all of your liabilities, you get equity. when a business purchases office supplies on account it needs to record these as supplies on hand. office supplies are usually considered an expense. once. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.chegg.com

Solved The assets, liabilities, owner's equity, revenue, and Is Office Supplies An Asset Liability Or Owner's Equity when a business purchases office supplies on account it needs to record these as supplies on hand. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. office supplies are usually considered an expense. Now let's look a closer look at each. items are purchased or. Is Office Supplies An Asset Liability Or Owner's Equity.

From testbook.com

[Solved] Accounting equation, "Assets = Liabilities + Owners Equ Is Office Supplies An Asset Liability Or Owner's Equity When you take all of your assets and subtract all of your liabilities, you get equity. But things can get tricky when dealing with office supplies, office expenses, and. once the liabilities have been paid from the assets, whatever is left represents the shareholders' equity, also known as the. Now let's look a closer look at each. although. Is Office Supplies An Asset Liability Or Owner's Equity.

From www.chegg.com

Solved The assets, liabilities, owner's equity, revenue, and Is Office Supplies An Asset Liability Or Owner's Equity items are purchased or sold, credit is extended or borrowed, income is made or expenses are assumed. But things can get tricky when dealing with office supplies, office expenses, and. Now let's look a closer look at each. when a business purchases office supplies on account it needs to record these as supplies on hand. although it. Is Office Supplies An Asset Liability Or Owner's Equity.

From dxopgwzwh.blob.core.windows.net

Types Of Owner's Equity Accounts at Zane Manson blog Is Office Supplies An Asset Liability Or Owner's Equity When you take all of your assets and subtract all of your liabilities, you get equity. As the supplies on hand are normally. But things can get tricky when dealing with office supplies, office expenses, and. Liabilities, on the other hand, are. office supplies are usually considered an expense. when a business purchases office supplies on account it. Is Office Supplies An Asset Liability Or Owner's Equity.